Businessfixx

This blog is for the people who have interest in business or they already have business.I will solve all kinds of business problem.

Friday, January 11, 2019

Thursday, January 25, 2018

Why you need Excel Service ?

- Pivot Table

- Excel Dashboard

- Apply formulas/Advance Filter

- Vlookup/Hlookup

- Countif/Countifs

- Sumif/Sumifs

- Data Validation

- Conditioning Formatting

- Drop down

- Redesign Excel worksheets to get it data more clean and neat

- Split text/data into different cells

- Removing duplicates

- Create Invoices for a raw data with automated Invoice Numbers

- Provide video tutorial also for any kind of help

- Convert any file to Excel or CSV from PDF, Word, scanned page

- All kinds of complex formulas

- Automated Interpretation of results

- Pivot Tables

- Charts

- Power Query

- Web Scrapping

- Automated Reports

- Dashboards

- Financial Statements

- Financial Analysis

- Macros

Why you need Bookkeeping services?

1. Keep your focus on core business needs.

A startup needs the attention of its founder, including his or her attention to growing the idea into a viable product or service. That means that, as that founder, your time should be devoted to strategy, marketing, funding and other key areas that require your focus over the daily operational tasks of a business.

2. Stay out of what you don’t really know or understand.

Not many founders have backgrounds in finance or even a working knowledge of accounts payable, accounts receivable and taxes. It’s better that a professional who took courses and was certified in these areas handle those aspects of the business.

That way, mistakes will be less likely, as well as issues that could cost you more money. Remember, if you miss a bill or forget to pay something important, this will significantly impact your business credit.

3. Calibrate a work-life balance.

While you could focus on core business needs and handle everything else in your startup, the problem is you’ll have no time left at the end of the day or week for yourself or your loved ones. Therefore, you’ll be missing that balance every person needs in order to stay healthy and not burn out on what you are doing.

4. Get a different perspective on the business.

Although you may believe you have a good idea about the state of your startup during the development phase, it helps to have another pair of eyes on this.

Your bookkeeper can put the financials in order and run reports showing how you are doing each month, where the funds are going and how your efforts are paying off (or might need improving upon). He or she will give you that "big picture" through the numbers being crunched.

5. Escape the tedious aspects of business.

It’s hard to imagine that the financial aspects of your business make you excited. You likely have no passionate feelings about tallying up payroll or writing checks to pay the bills.

However, your bookkeeper may enjoy those tasks, so it makes sense to hand over these areas to someone who does them -- and does them well -- because of that motivation.

6. Make sure everything is paid on time.

Between traveling, keeping the startup moving forward, putting out the daily fires that pop up and staying balanced, something most likely gets left out along the way. And that often ends up being the bills that need to get paid.

You don’t want your credit impacted by late or forgotten payments, so put a bookkeeper in charge to give you the confidence that everything has been handled on time.

7. Ensure correct tax filings.

The last thing you want is to get audited or have the taxman after you just because you forgot those quarterly or annual tax filings. Depending on the type of business structure you’ve created for your startup, you will have various tax requirements, including estimated tax payments, corporate tax payments, 1099s for contractors or freelancers and other filings. It’s ideal to find a bookkeeper who can handle taxes a well as payroll and other financial issues.

8. Maintain cash flow.

Because you are so busy, you may not realize that there are outstanding payments from your client base. Any late payments here could infringe upon the cash flow you need to keep your startup humming along.

With a bookkeeper working for you,he or she can stay on top of this and send out reminders to make sure your cash flow remains optimal. This will also look good when it’s time to seek another round of funding because you can show positive cash flow you might not have been able to show without that assistance.

9. Resolve conflicts of interest with any business partners.

With more than one founding partner, issues could arise where each partner has some idea of how the money should be spent and how to easily access it. Otherwise, conflict could arise that could impede the progress of your startup.

That's why a bookkeeper should be the gatekeeper of the money, creating the necessary approval processes that stop partners from just withdrawing money.

10. Reduce the cost of financial obligations.

Although you may think you save money by doing everything yourself, the fact is that a professional bookkeeper actually saves you more. That’s because there is a reduced level of risk for human error, lack of knowledge, missed payments and tax obligation due dates and delayed accounts receivable.

WHY YOU NEED A BUSINESS PLAN?

WHY YOU NEED A BUSINESS PLAN?

- To attract investors.

- To attract partners.

- To fix your financial needs.

- To get Loan from Bank.

- To establish business’s goals.

- To map the future of business

- To support growth and confident funding

- To progress and interconnect a course of action

- To help manage cash flow

- To prove that you’re serious about your business.

- To better understand your opposition.

- To better understand your clients.

- To assess the probability of your project.

- To file your revenue model.

- To reduce the risk of the wrong opportunity.

- To know really your market.

- To plot your course and focus your efforts.

- To set a position for your brand.

- To justify the success of your business.

- To document your marketing plan.

- To understand and forecast your company’s staffing needs.

- To uncover new opportunities.

Monday, January 8, 2018

How can you get loan easily from Bank or Investor?

|

| Loan Approved |

Small business loans are available from a big number of traditional lenders. Small business loans will help your business to grow, a fund for new research and development, that will help you to expand into new grounds, increase sales and marketing labors, permit you to employ new people, and more. I will share here about getting the loan from a bank with some practical advice and insight.

Reason for your Business Loan

You must ensure the reason for your loan to the lender. Business owners need to clearly articulate why they want the business loan and how much(amount) it's needed.

Visit Your Local SCORE and SBDC Offices

If your business is a start-up, you may want to get some guidance and help from the experienced businessman. If you have a division of SCORE in your zone, they are a delightful and free source of guidance and help. SCORE is a non-profit group of retired business directors. You can get online guidance and online counseling. You may go to Small Business Development Center (SBDC) if you have a nearby university.

Review the Credit History and Credit Score

If your

business is a start-up or less than three years old, your particular credit

history will be assessed as well as your business credit history. Before

applying you must ensure your positive credit history. You have to request your

credit report from the major credit reporting organizations. Review

the credit reports. If everything is ok, then apply for the loan.

Start Reviewing Your Borrowing Options

Find out the

commercial banks available for you.

Don't go to the large, national banks. You may have a better

chance for a loan at the smaller commercial banks who are agreed to consider

the loan with low requirements. Some other non-bank institutions may have

options for you like credit unions. There are other options

like microfinance loans that make consider loans to startups. If one

lender denies you, then another may consider you. so keep trying.

This is the most important step.

If you want to get a small business loan from any lender, you must have to prepare a good business plan for any business plan writer. In fact, if you have a good business plan, chances to get a loan will be increased by 80%. The business plan is another requirement of the application required by the financial institution like bank or lender. You must include your details in the business plan. Actually, bank or lender or investor will be influenced by your business plan.

Plan a Presentation and Make the Appointment

You have to Prepare a presentation business plan and application for your loan officer or investor.

Financial forecast has to be in spreadsheets with charts and graphs necessarily.

You have to include in the business plan the followings

· Executive Summary,

· Mission

· Vision

· Market analysis

· Competitor analysis

· Market opportunity

· Target Market

· Market strategy

· Management strategy

· Market analysis

· SWOT analysis

· Financial forecast/Profit & loss/Cash Flow

Financial Plan

★1/3/5 years forecasting Balance sheet

★1/3/5 years forecasting P/L

★Break-even analysis

★1/3/5years Cash flow analysis

★Start up cost

Many loan officers/investor read the Executive Summary at first and decide to make the decision whether consider the next step. Ensure an appointment with your loan officer or Investor and request time to do a good presentation, with visual aids, built on your business plan.

Saturday, December 16, 2017

9 Reasons you need a Business Plan

|

| Business Plan |

A business plan is a mirror of your business. No one needs to go to your business to visit your business. Anyone can get that by your business plan. This will tell what you have to do step by step to make it successful. You can write this by yourself with the help of a business plan writer. In Google, there is lots of business plan template word format. You can download any of them and start to write your plan. Also, there is lots of online business plan company who can prepare your business plan through online.

A business plan has a great effect on business growth. The more time you will spend here to analysis the business the more response you will get from buyer /customer or client.

Business loan application

To get a loan you must apply to Bank. But Bank will not consider you any money without knowing your ambitions. You must show your strategy through a business plan. You must show there the loan you must need to set up the business. You have to explain your future plan in the business plan. A business plan outline will give you a great opportunity. You must influence him to consider your loan.

Looking for investor to invest in your business or idea

Are you looking for a new investor? Great! Make a great plan for your investor and influence him with your presentation. Please don’t misrepresent the plan. It will hamper your total idea.

For New Business

Do you want to start a new business? Have you a good idea? Great! Make a plan for your business. Make a plan for marketing, management, finance etc. Set up your total business in the business plan. Write your objectives in the plan. This will help you to go a long way.

To Sell business

Before selling you must need a business plan. In a business proposal format, you must show the total business structure. You have to do the SWOT analysis in the plan. Buyer will have attracted with the SWOT analysis.

Develop the business to new dimension

If you are thinking to develop your business you must have a dynamic plan to make it. write about the new idea and how you will optimize it.

Share with shareholder about the business, Management, and future objectives

In the large company, the shareholder will ask for the business plan at the annual meeting. They want to see what’s the business’s future plan to make the profit.

Make a plan for future growth

A business plan structure will tell you where is the business is now. If you ask “what is a business plan” then I will tell you it’s a plan which can tell me details about your idea, planning, utilization.

Order Your Business Plan

Order Your Business Plan

Sunday, December 3, 2017

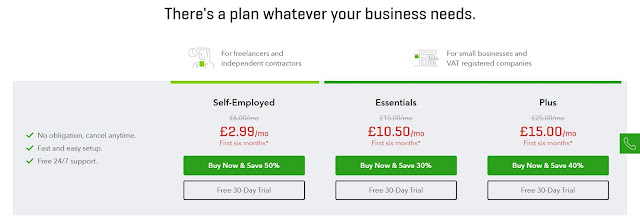

Best accounting software for business

|

| Accounting Software |

Every Business should have an accounting software.here is a list of some software i can recommend for you.If you budget is low you can choose Quickbooks. One of the best software is business industry.The price of this software is reasonable.You can pay monthly basis.

95% American's small businessman are using this software.This software has 3 plan for you.

The most important thing is quickbooks give you 1 month free using permission.

|

| Best accounting software |

Benefit of Quickbooks

- Money Management

- Expense Billing

- Sales Invoicing

- Online bank adding options

- Anytime data edit or update option

- Reporting

- User Friendly

Here is quickbooks pricing

Hope my suggestion will help you do start your business

There are some accountant who will provide you accounting service through online

Online accounting service provider will charge you $10-$15 per month for management of your business's accounting and bookkeeping.They can provide you any kind of help about your business's total accounting.

Subscribe to:

Posts (Atom)

-

Pivot Table Excel Dashboard Apply formulas/Advance Filter Vlookup/Hlookup Countif/Countifs Sumif/Sumifs Data Validation Cond...

-

Business Plan A business plan is a mirror of your business. No one needs to go to your business to visit your business. Anyone c...